Individual Giving

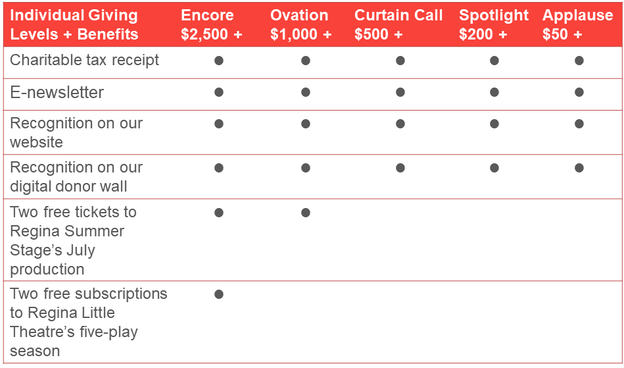

The Regina Performing Arts Centre (RPAC) relies on revenue from government grants, foundations, and corporate sponsorships, but individual gifts are gratefully accepted, too. In fact, donations of this kind are becoming increasingly important as other sources of funding shrink.

Since 2013, over $500,000 has been raised for much-needed capital improvements. Unfortunately, one-time funding opportunities responsible for hefty amounts raised in years past have been exhausted. That's why your gift, no matter how big or small, is crucial to RPAC's continued operation.

The Regina Performing Arts Centre is a busy facility that requires ongoing maintenance and upgrades to keep its doors open. More improvement projects must be undertaken, and that's where you can help. Donate now to secure RPAC's future.

Since 2013, over $500,000 has been raised for much-needed capital improvements. Unfortunately, one-time funding opportunities responsible for hefty amounts raised in years past have been exhausted. That's why your gift, no matter how big or small, is crucial to RPAC's continued operation.

The Regina Performing Arts Centre is a busy facility that requires ongoing maintenance and upgrades to keep its doors open. More improvement projects must be undertaken, and that's where you can help. Donate now to secure RPAC's future.

Ways to Donate

Regina Performing Arts Centre

1077 Angus Street Regina, Saskatchewan S4T 1Y4 Charitable tax receipts are issued for donations of $20 or more.

Charitable No. 127188571 RR0001 |

More Giving Options

Employer Matching ProgramsMany companies match the charitable contributions of their employees dollar for dollar. Some even match to spouses and retirees. Check with your employer's Human Resources department to see if they offer a matching gift program. You may be able to double or triple the impact of your donation. For a list of some of the Canadian companies that offer matching gift programs, click here.

|

Gifts of SecuritiesPublicly traded securities (stocks, bonds, mutual funds) that have appreciated in value are exempt from the capital gains tax due on their sale if they are transferred to a registered charity. A charitable tax receipt for the full market value of the donated asset is issued, making the handover a double win for you. Transferring securities is easy. Talk to your financial advisor to get the ball rolling.

|

Legacy GivingIt's easy to remember Theatre Regina (RPAC's owner and operator) in your will, but it isn't the only planned giving option. Investments, real estate, retirement plan benefits, and life insurance policies also provide opportunities for you to meet your financial and philanthropic goals. If you want to make a lasting contribution to Regina's cultural community, consider including us in your estate plan.

|